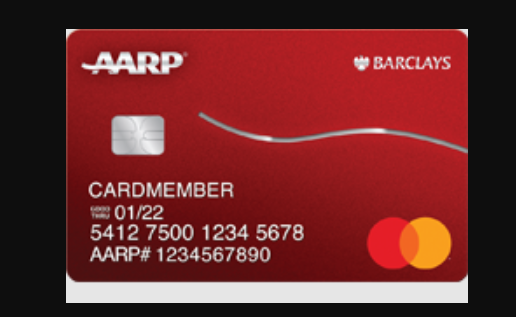

AARP MasterCard Login :

The AARP Credit Card from Chase offers great compensation on feasting and gas, regardless of whether you’re not among AARP’s vital segment of Americans age 50 and more established.

This is particularly obvious given the card’s $0 yearly fee. But relying upon where you do the heft of your spending, different cards might be better fits or offer more adaptable prizes.

Rates and Features of AARP MasterCard:

- $100 beginning reward

- 1% to 3% money back on buys

- No yearly charge

- Somewhat sub-optimal ordinary APR

- Unfamiliar exchange charge is 3%

- Equilibrium move expense is 3%

AARP MasterCard Login:

- To log in open the page www.barclaycardus.com

- After the page opens at the center click on the ‘Cardmember login’ button.

- On the next screen, you have to enter a Username password, click on the ‘Login’ button.

Retrieve AARP MasterCard Login Initials:

- To retrieve the login details, open the page www.barclaycardus.com

- As the page appears under the login spaces click on the ‘Forgot username or password button.

- In the next screen, provide the last four numbers of social security, date of birth, account number hit on the ‘Continue’ button.

Register for AARP MasterCard Account:

- To register for the account open the page www.barclaycardus.com

- After the page opens in the login screen click on the ‘Set up online access’ button.

- In the next screen provide the SSN, date of birth, account number, choose your occupation, specify if you are a US citizen. Now hit on the ‘Continue’ button.

Also Read : Kohl’s Charge Card Bill Payment Guide

AARP MasterCard Benefits:

- The Card’s Extra Classifications Are a Helpful Pair: For buyers who spend an enormous segment of their financial plan on feasting out and gas, this card procures rich prizes: 3% money back on eateries, including both, plunk down assistance or inexpensive food, and at service stations. Any remaining buys bring in 1% money back. On the off chance that food supplies are a greater cut of your financial plan than gas is, you could settle on the $0-yearly charge Capital One Savor One Cash Rewards Credit Card. It takes care of 3% money on feasting and diversion, 2% back at supermarkets and 1% on all the other things.

- The Prizes You Acquire Aren’t Chase Ultimate Rewards: Because the AARP Credit Card from Chase is a co-marked card, the prizes you procure aren’t Chase Ultimate Rewards, which implies you can’t consolidate them with focuses from other Chase cards or move them to the Chase Sapphire Preferred Card or Chase Sapphire Reserve for higher reclamation esteem.

- There Is an Unobtrusive Sign-Up Reward: The card accompanies a sign-up reward: $100 Bonus Cash Back after you burn through $500 on buys in the initial 3 months from account opening. That is not terrible, but rather a few options highlight a lot higher sign-up rewards, including the entirety of the previously mentioned cards the Capital One Savor One Cash Rewards Credit Card.

- You Don’t Need to Be an AARP Part to Apply: Anyone can apply for this card, paying little mind to age or AARP enrollment status. You additionally can utilize your compensations to pay for your $16 yearly AARP enrollment fee. The Wells Fargo Propel American Express card offers triple focuses on eating out and requesting in, and on corner stores, rideshares, and travel, alongside movement and select real-time features. All non-reward classification spending procures 1-point back.

- A Segment of Your Eatery Spending Goes to Noble Cause: Every time you use AARP Credit Card from Chase at cafés, a dime is given to the AARP Foundation’s Drive to End Hunger crusade. Pursue says it has helped raise more than $10.7 million since 2011, or what might be compared to of 3.5 million dinners for more seasoned Americans. For those hoping to help AARP’s main goal of enabling individuals as they age, this magnanimous component is a key differentiator and one you can’t discover on another card.

AARP MasterCard Contact Help:

For more help call on 877-523-0478.

Reference Link: